The Rise of Digital Money in Dubai: Crypto, Payments & New Regulations

Explore how digital money is rising in Dubai. Crypto adoption, smart payments, regulations, and future trends explained in a simple 2025 guide.

Discover how Bitcoin is transforming real estate investment in the Middle East. Learn regulations, benefits, risks, trends, and market insights reshaping property transactions.

The Middle East is witnessing a major shift in how people invest in property. With the rise of Bitcoin, digital assets, and blockchain-powered payments, real estate developers and investors are exploring new ways to complete transactions. Dubai, Abu Dhabi, Qatar, Bahrain, and Saudi Arabia are already seeing rapid interest as global investors use Bitcoin to buy premium properties, luxury villas, apartments, and commercial units.

In a region known for innovation, cryptocurrency is becoming a new gateway to attract international buyers who want secure, fast, and borderless investment options.

There are several reasons why Bitcoin transactions are attracting Middle Eastern property investors:

For many foreign buyers, Bitcoin simplifies the entire buying process and eliminates traditional payment restrictions.

Dubai has become a global leader in accepting cryptocurrency within the property sector. Major developers and brokers now allow partial or full payments using Bitcoin.

This popularity is driven by:

The UAE’s flexible and modern legal framework accelerates Bitcoin adoption faster than most global cities.

Overall, most Middle Eastern countries allow real estate + Bitcoin transactions if proper verification and licensed intermediaries are involved.

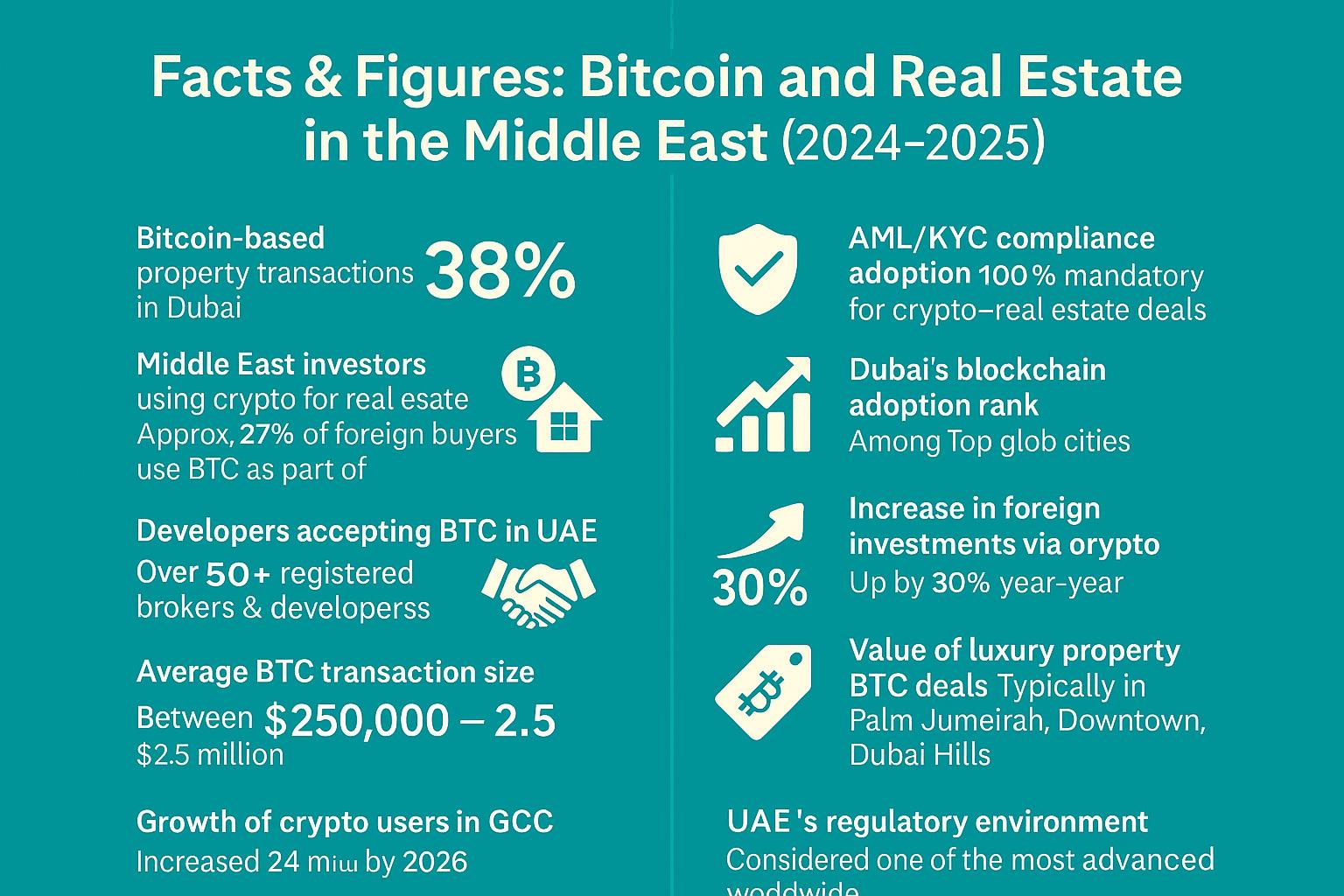

| Category | Insights & Data |

|---|---|

| Bitcoin-based property transactions in Dubai | Increased by 38% in 2024 |

| Middle East investors using crypto for real estate | Approx. 27% of foreign buyers use BTC as part of payment |

| Developers accepting BTC in UAE | Over 50+ registered brokers & developers |

| Average BTC transaction size | Between $250,000 – $2.5 million |

| Growth of crypto users in GCC | Expected to reach 24 million by 2026 |

| AML/KYC compliance adoption | 100% mandatory for crypto–real estate deals |

| Dubai’s blockchain adoption rank | Among Top 5 global cities |

| Increase in foreign investments via crypto | Up by 30% year-on-year |

| Value of luxury property BTC deals | Typically in Palm Jumeirah, Downtown, Dubai Hills |

| UAE regulatory environment | Considered one of the most advanced worldwide |

Yes, especially in the UAE, as long as transactions go through licensed platforms.

Only through registered brokers or regulated crypto payment gateways.

No. Payments are converted through licensed intermediaries.

Fast payments, global access, and reduced banking restrictions.

Risks exist due to price volatility, but regulated platforms reduce risks.

UAE and Bahrain lead in the region.

Yes—Bitcoin is ideal for international buyers investing remotely.

Yes, especially in Dubai’s premium locations.

Passport, KYC verification, source of funds, and transaction proof.

Yes—trends show strong adoption from developers and investors in 2025 and beyond.

John Smith specializes in writing compelling, research-based blog content that boosts visibility and audience engagement. His writing style is crisp, informative, and easy to read.

Explore how digital money is rising in Dubai. Crypto adoption, smart payments, regulations, and future trends explained in a simple 2025 guide.

Discover the real cost of living in Dubai in 2025. Rent, utilities, food, transport, schooling, and monthly expenses in a simple and clear guide.

Discover the top real estate developers in Dubai for 2025. Compare Emaar, Damac, Nakheel, Sobha, and more. Best options for buyers and investors.

These cookies are essential for the website to function properly.

These cookies help us understand how visitors interact with the website.

These cookies are used to deliver personalized advertisements.