The Rise of Digital Money in Dubai: Crypto, Payments & New Regulations

Explore how digital money is rising in Dubai. Crypto adoption, smart payments, regulations, and future trends explained in a simple 2025 guide.

Explore how digital banking is transforming the Middle East through innovation, mobile-first banking, AI-driven services, and customer-centric financial technologies.

The Middle East is entering a new era of financial transformation. Over the past few years, digital banking has shifted from a convenient option to the preferred method of managing money. Countries like the UAE, Saudi Arabia, Bahrain, and Qatar are leading this change with advanced regulations, mobile-first banks, AI-powered services, and innovative FinTech ecosystems.

As customers demand simpler, smarter, and faster financial services, banks across the region are reshaping their strategies—making 2025 and beyond a defining period for the future of finance.

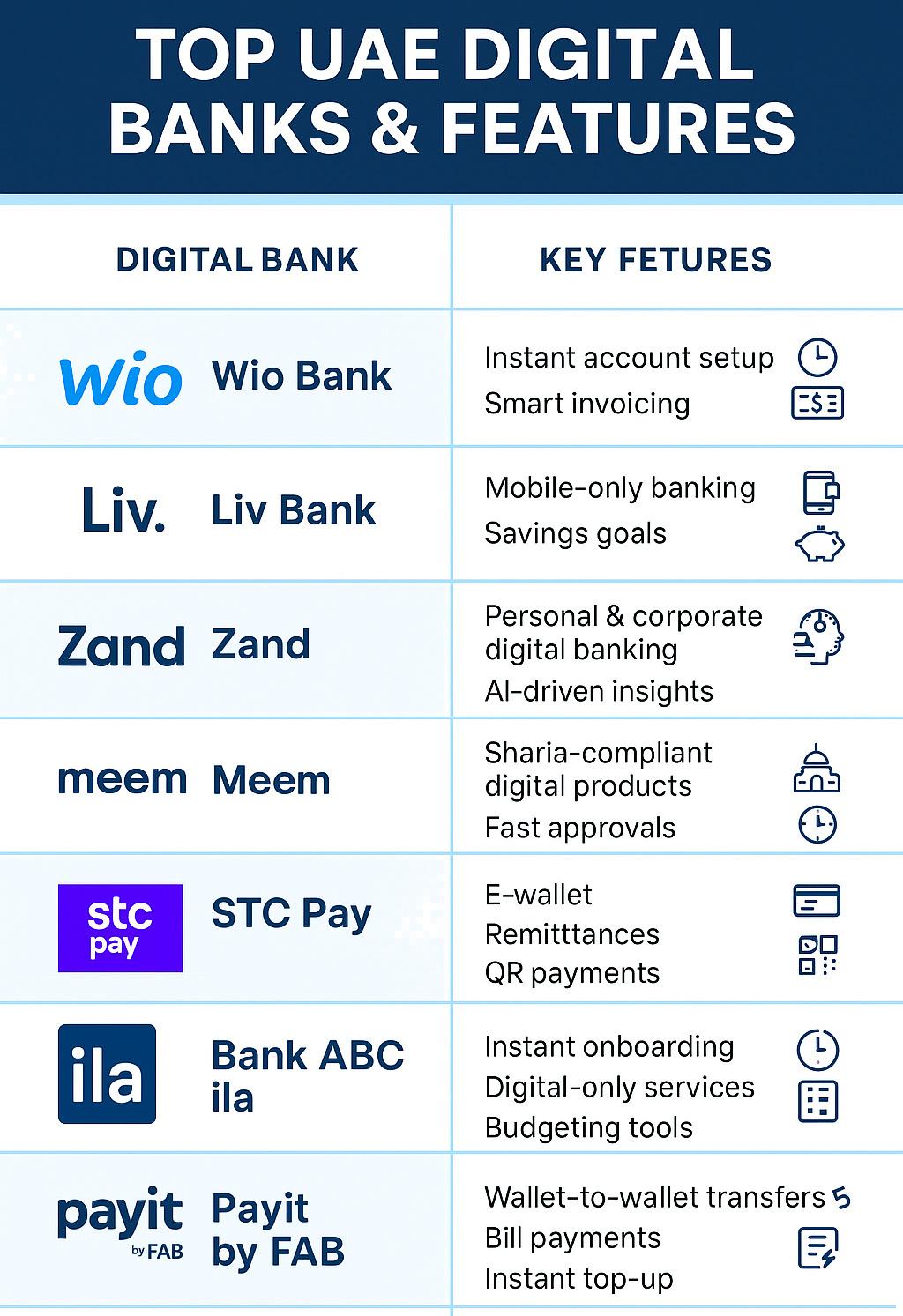

Digital-only banks—or neobanks—are expanding rapidly in the Middle East. These banks offer fully online account openings, instant payments, budgeting tools, and smart saving features.

Customers prefer mobile-first financial services because:

Examples include Wio Bank, Liv Bank, Meem, and Zand.

Artificial intelligence is becoming the backbone of digital banking. Banks now use:

This shift allows banks to deliver smoother, more accurate, and more secure experiences.

The GCC region is heavily investing in blockchain-powered banking for security, compliance, and transparent payments. Governments also support digital payment adoption, encouraging cashless lifestyles.

Key trends include:

Open banking is one of the biggest drivers of innovation. With customer permission, financial data can be securely shared between platforms, enabling:

Countries like Bahrain and Saudi Arabia have already implemented open banking frameworks, with the UAE preparing for broader adoption.

As digital banking grows, so do security threats. Banks are investing in advanced systems such as:

This ensures customers remain protected as financial activity becomes increasingly digital.

Small and medium businesses are benefiting from new digital banking tools such as:

Banks are shifting toward offering full-service digital platforms tailored for entrepreneurs.

Users now expect banks to help them manage money—not just store it.

PFM tools include:

This trend is especially popular among younger customers.

Middle Eastern countries are building world-class FinTech hubs:

These environments accelerate innovation and partnerships between banks, tech companies, and startups.

| Digital Bank | Country | Key Features |

|---|---|---|

| Wio Bank | UAE | Instant account setup, smart invoicing, UAE Pass login, SME banking |

| Liv Bank | UAE | Mobile-only banking, savings goals, lifestyle rewards |

| Zand | UAE | Personal & corporate digital banking, AI-driven insights |

| Meem Bank | Saudi Arabia | Sharia-compliant digital products, fast approvals |

| STC Pay | Saudi Arabia | E-wallet, remittances, QR payments |

| Bank ABC ila | Bahrain | Instant onboarding, digital-only services, budgeting tools |

| Payit by FAB | UAE | Wallet-to-wallet transfers, bill payments, instant top-up |

| Mashreq Neo | UAE | Digital onboarding, international transfers, virtual cards |

Digital banking is the use of online and mobile platforms to access banking services without visiting a branch.

Because customers want faster, easier, and more modern financial services supported by strong government initiatives.

The UAE is currently the strongest digital banking hub in the region.

Yes, they follow strict regulations and use advanced security like biometrics and encryption.

Lower fees, instant services, easy onboarding, and 24/7 access.

Yes, many digital banks now offer SME-focused tools like smart invoicing and instant business accounts.

A system that allows secure sharing of financial data to create better, personalized financial services.

AI improves security, customer support, fraud detection, and personalized financial planning.

Not fully, but they will drastically reduce as digital adoption grows.

More mobile-first banks, stronger cybersecurity, AI-driven platforms, and cashless ecosystems.

John Smith specializes in writing compelling, research-based blog content that boosts visibility and audience engagement. His writing style is crisp, informative, and easy to read.

Explore how digital money is rising in Dubai. Crypto adoption, smart payments, regulations, and future trends explained in a simple 2025 guide.

Dubai’s fitness culture is growing faster than ever. From smart gyms to daily wellness routines, people across the city are investing in health gadgets that track, guide, and improve their lifestyle. As a business owner in Dubai, understanding these trends helps you position your products, services, or content to capture an already booming market.

Discover why Dubai residents are rapidly adopting smart wellness wearables. Explore top devices like WHOOP, Oura Ring 4, Fitbit Charge 6, and Apple Watch Series 10 with benefits, features, and comparison tables.

These cookies are essential for the website to function properly.

These cookies help us understand how visitors interact with the website.

These cookies are used to deliver personalized advertisements.